BHIM App Launched by PM Modi: Here’s Everything That You Need To Know

7 years ago Admin 0

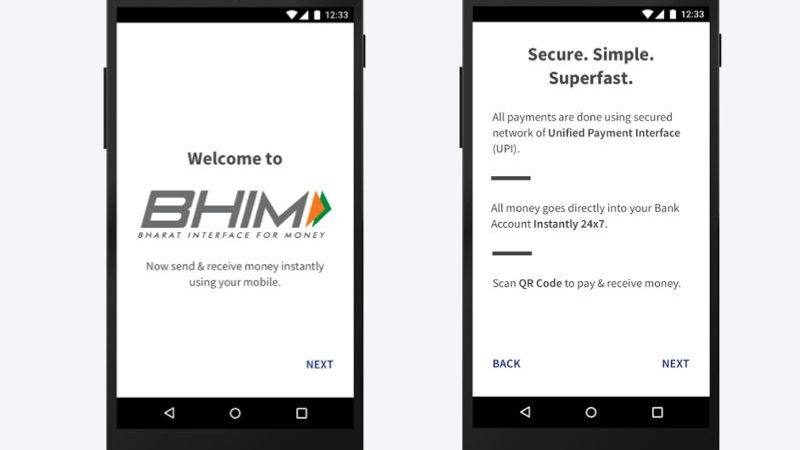

To make the route to demonisation easier, Prime Minister Narendra Modi launched the app called BHIM, which stands for “Bharat Interface for Money”. The app is based on UPI (United Payments Interface) and aims at easing out everyday digital transactions directly from bank accounts. The app is connected to your bank account. BHIM is also supposed to support Aadhaar-based payments, where transactions will be possible just with a fingerprint impression, but that facility is yet to roll out.

Only available on Android for now, the app lets users pay and receive money with no processing fee. A transaction cost, however, may be levied by the user’s bank. For now, the app lists 30 banks including SBI, HDFC, ICICI, Union Bank of India, South India Bank, and Standard Chartered, among others. To find the app on the Play Store, search for BHIM UPI, else what you will end up with is a list of Chhota Bheem apps!

The BHIM app enables everyone with a bank account to pay or receive money via online banking. Unlike digital wallet, this app does not ask the user to transfer the money to the wallet first.

At the launch, PM Modi said, “Be it a smartphone or feature phone of Rs 1,000-1,200, BHIM app can be used. There is no need to have Internet connectivity. One only needs a thumb. There was a time when an illiterate was called ‘angutha chhap’. Now, time has changed. Your thumb is your bank now. It has become your identity now.”

How to download BHIM app?

The app is available on Android, click here for downloading the app. It will soon be made available on iOS too. For the feature phone users, you can access the app without the internet by dialling *99#.

How to use BHIM app?

After successfully installing the app on your Android phone, open the app and register your bank details and also select a UPI PIN for security. The app uses your mobile number as the payment address, which automatically enables the user for transactions on the app. On BHIM app, the user can send money to a phone number, bank account, check account balance, or also pay by scanning a QR code (similar to PayTM). All these transactions do not even require the user to share his/her phone number. One can also create Custom Payment Address in addition to their phone number.

Also, users can send money to non-UPI banks by entering IFSC codes, similar to the internet banking.

Which Banks are supported by BHIM app?

There’s a pretty comprehensive list of banks that are supporting BHIM app for UPI-based payments. The list includes Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, and Vijaya Bank.

What is the transaction limit on the BHIM app?

A user can transfer up to Rs. 10,000 per transaction and up to Rs. 20,000 in a day.

So exactly does BHIM work? How many accounts can I link to the BHIM app to make payments?

BHIM lets you choose your preferred bank after it has verified your mobile number. The app sends an SMS via the SIM in your phone. So it is best if your phone has the same mobile number as the one that is linked to a bank account.

Make sure there is enough balance for BHIM to send out an SMS. In our case, we’ve gotten some cases of device binding failure, but after a couple of tries the app got synced in one of phones. The app will then ask you to set a passcode (4 digit), which you can choose. Keep something you don’t forget easily because you will need the code every time you open the app.

Once that is done, the app will ask you to select from the relevant bank. Choose your bank, if UPI is activated it will reflect the relevant account number, and you’ll be able to see an option to send money, receive money, share via IFSC code.

If UPI is not activated, you can just put in six digits of your debit card and the expiry date. You then create a UPI pin. Once done, the app will let you perform the needed functions.

Then just click on send money. Type in the mobile number or bank VPA address. It will also verify the user to whom you are sending the money. Type in the amount, and hit pay.

If your friend doesn’t have UPI, on top of the send money option, you will see three dots. Tap on that and the ACCOUNT+IFSC option will open up. Put in the details there, and you’ll be able to transfer money.

The problem is that if your mobile number is linked to two accounts, you can only access one for now. If you want to switch, you have to disable the selected one and go back to the bank selection option again. To transfer money you just need your friend or even merchant’s mobile number or VPA which they should be able to give if they have a UPI account.

The Prime Minister also said that biometric payment system based Aadhar Payment app will also go live within two weeks. Given the speedy launch of government-backed digital payments apps, it would be interesting to see how successfully the rural population adapts these methods.