PM Narendra Modi launches BHIM-Aadhaar Pay app

7 years ago Admin 0

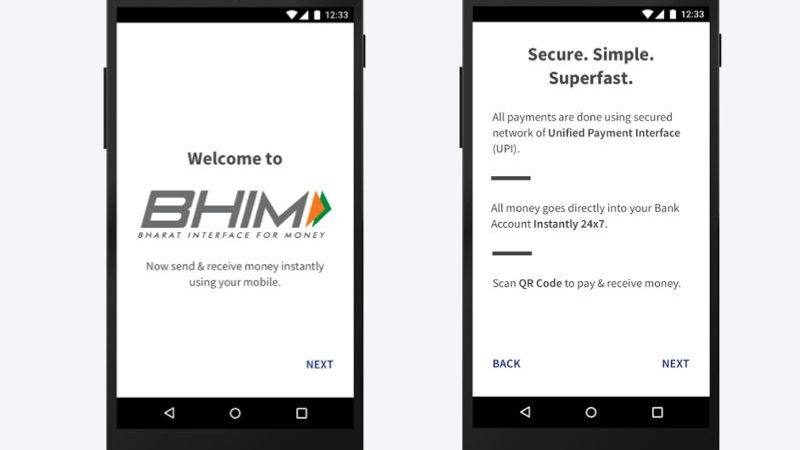

The National Payments Corporation of India today announced the launch of mobile application for Aadhaar-based payments through Bharat Interface for Money (BHIM) app for merchants.

The service was launched by Prime Minister Narendra Modi in Nagpur today. The new service will allow customers to make purchases using their Aadhaar number linked with their bank account. The transaction will require customer’s fingerprint for authentication.

“This will directly cater to about 40 crore bank account customers spread across the country whose account is linked with Aadhaar. It is a huge opportunity for enabling digital transactions as about 99 percent of the adult population is now aadhaar enabled,” NPCI managing director and CEO, A P Hota said.

Currently, over 30 banks are participating on BHIM Aadhaar and more member banks shall be on-board, NPCI said. BHIM Aadhaar would be applicable for retail merchants only and not for corporate merchants, it said. BHIM is a smart mobile phone based app based on Unified Payments Interface (UPI) that allows simple, easy and quick payment transactions using UPI.

The BHIM app was originally launched by Prime Minister Narendra Modi to increase cashless transactions. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. Your friend, relative or even a merchant who you’re trying to pay doesn’t necessarily need to be on the BHIM app. All they need is a bank account to receive the payment.

BHIM also has options to transfer via IFSC, MMID as well for non-UPI banks. It also means the government has decided to go with one app that will enable digital payments via UPI.

The merchant should have BHIM Aadhar app installed on his phone along with a fingerprint authenticator. At the time of payment, the customer should select his bank account and enter his 12 digit Aadhaar card number in the app, and after that, he should scan his fingerprint to make the payment. That’s it. The payment will be carried out without any barcode scan or QR code scan and importantly without the need for a smartphone.